SWOT Analysis of Performance Analysis of Primark

| ✅ Paper Type: Free Essay | ✅ Subject: Finance |

| ✅ Wordcount: 3506 words | ✅ Published: 04 Sep 2017 |

PowerPoint Presentation and Written Assessment

Executive Summary

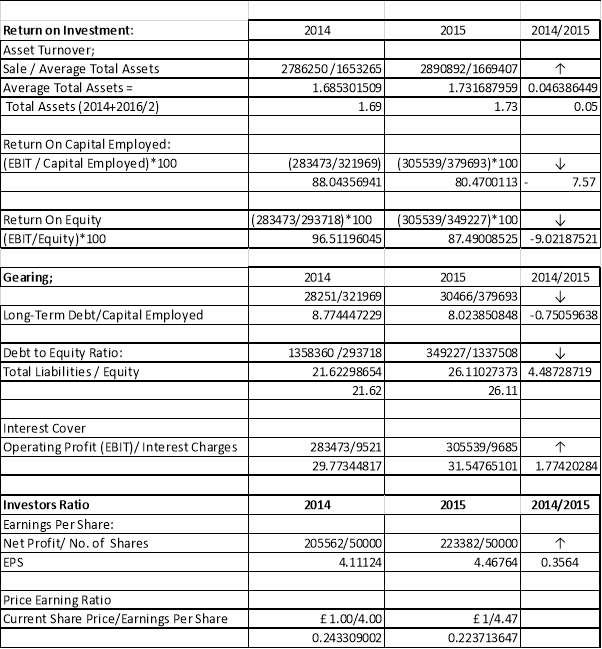

This report provides information to potential investors using ratio analysis to examine profitability, liquidity, efficiency, the gearing of Primark Ltd for 2015. The report will pay much attention to earning power, liquidity, credit management, debt management, inventory management, and capital structure of Primark by comparing it with three other competitors: Next Plc, TJX UK and House of Fraser. The report highlight on major strength, weakness, opportunities and threats of Primark within the Fashion retail business to aid potential to make a better-informed decision to invest in Primark. The report analyses the financial situation of Primark with its competitors and provides a recommendation for improvement. Primark recorded a significant increase of 7.57% of Return on Capital Employed (ROCE). 2015 saw an increase of 3.76% in turnover.

Business and Financial Situation

Primark is a subsidiary of the Association of British Food (ABF) Group. The company was incorporated in 1969 in Ireland trading with the name Penny’s. Primark is headquartered in Dublin. Primark has grown over the years to carve a niche for itself to be a major high street clothing retailer with an appearance of over 238 branches in UK, Ireland and Europe.

Primark offers inventive, trendy clothes at value-for-money prices. Like several fashion retail companies, Primark does not manufacture its products itself. The firm works with suppliers to produce to its requirement. The firm relies on low cost, economies of scale and efficient distribution strategies to sustain its competitive market position.

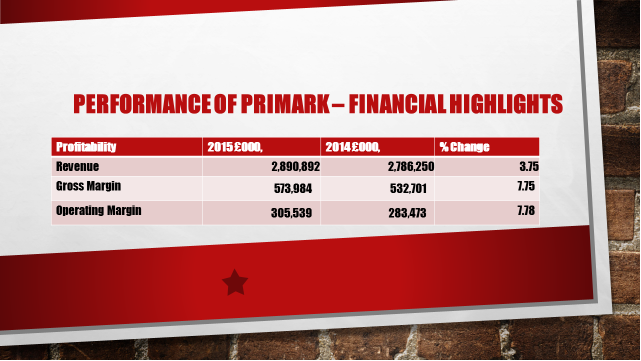

Turnover of Primark between the financial years 2015 and 2014 increased from 2,786,250,000 to 2,890,892,000 which indicates an increase of 3.76% of the 2014 turnover. Primark recorded an 80.47% Return on Capital Employed (ROCE) for 2015 which is 7.57% increase of 2014 ROCE.

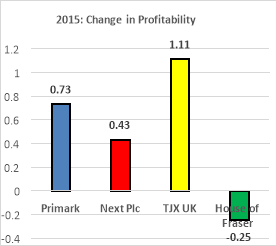

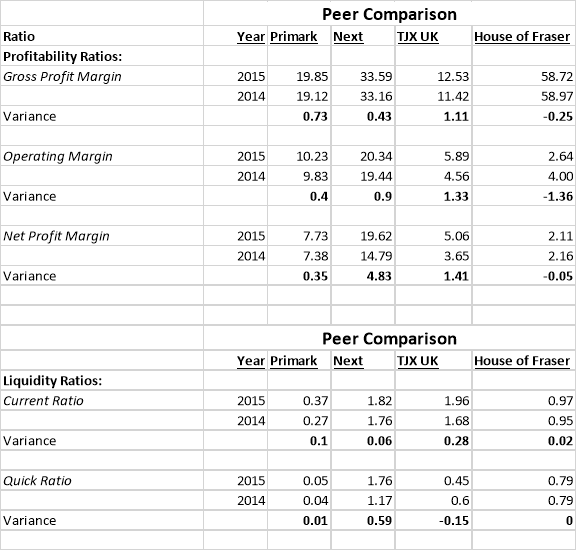

Profitability of Primark for the year under review did not see much improvement. Primark gained a feeble 0.74% and 0.40% for gross profit margin and operating profit margin respectively. The net profit margin, on the other hand, saw a partly 0.35% in net margin. Overall, profitability grew under 1% for the year under review. There could be many factors causing this partly less than 1% increase in profitability. Competition, increase in operating expenses, the general economy, etc.

Profitability of Primark for the year under review did not see much improvement. Primark gained a feeble 0.74% and 0.40% for gross profit margin and operating profit margin respectively. The net profit margin, on the other hand, saw a partly 0.35% in net margin. Overall, profitability grew under 1% for the year under review. There could be many factors causing this partly less than 1% increase in profitability. Competition, increase in operating expenses, the general economy, etc.

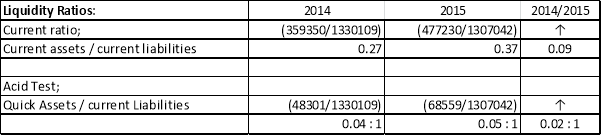

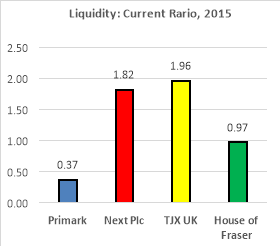

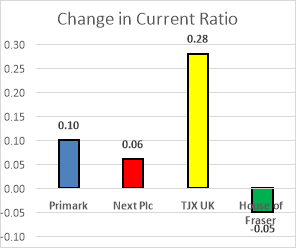

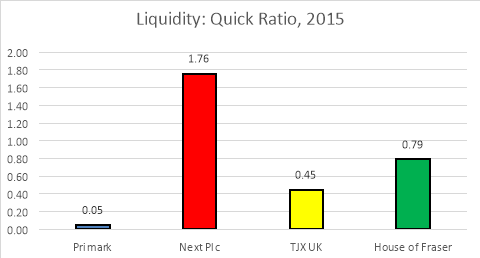

The Liquidity ratios analyse Primark’s ability to meet its short-term obligations as and when they fall due. In general, the ratio assesses how easy it is for Primark to convert its assets into cash. The acceptable range of current ratio is between 0.5 and 2.0. Current ratio and quick ratio saw a partly increase of 0.09 and 0.02 respectively which indicates Primark is operating outside the acceptable range of current ratio. In reality, the current and acid test ratios do not indicate Primark is risky for investors, but Primark operates in an industry where cash is the standard

The Liquidity ratios analyse Primark’s ability to meet its short-term obligations as and when they fall due. In general, the ratio assesses how easy it is for Primark to convert its assets into cash. The acceptable range of current ratio is between 0.5 and 2.0. Current ratio and quick ratio saw a partly increase of 0.09 and 0.02 respectively which indicates Primark is operating outside the acceptable range of current ratio. In reality, the current and acid test ratios do not indicate Primark is risky for investors, but Primark operates in an industry where cash is the standard

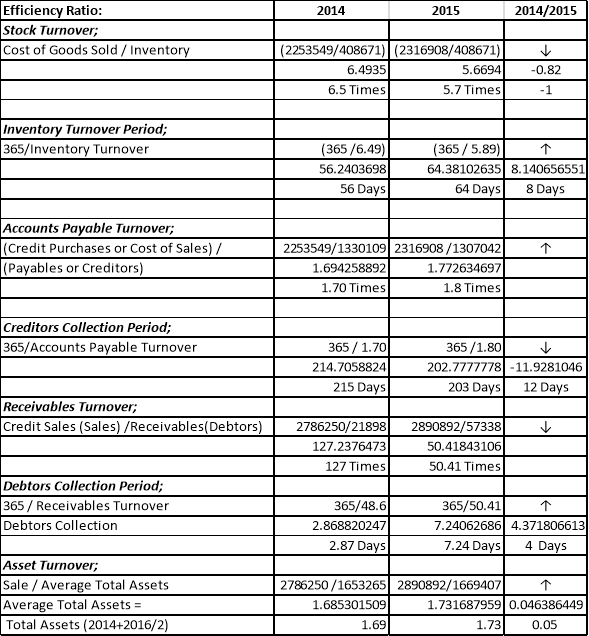

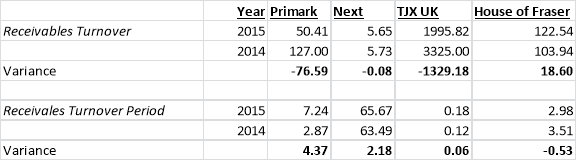

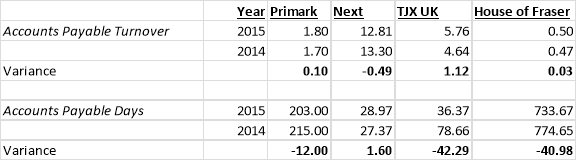

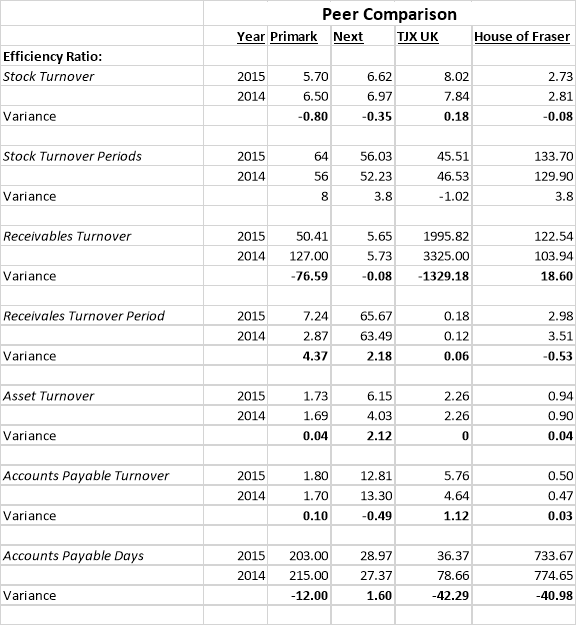

Primark’s activity ratios show how it has been effective in utilising its assets to generate income, how long it takes to collect cash from its sales and also make payment for its purchases. Primark’s inventory turnover times saw a drop of 1 stock turnover times in 2015 which translated into an increase in the number of inventory turnover period by 8days. This means Primark now require 8 more days to sell off its inventory. Primark has a favourable creditor’s collection period which allows them ample time to sell off inventory then make payment to suppliers. A 0.10 drop in accounts payable turnover translates into 12 days reduction in creditor’s collection periods in 2015 which is still favourable to Primark. This indicates Primark mostly buy its inventory on credit. Receivables turnover has reduced from 127 times in 2014 to 50.41 times in 2015. This reduction in receivables turnover translates into an increase of 4 days from 2.87 days in 2014 to 7.24 days in 2015.

The increases of 0.05 in asset turnover in 2015 translated into an increase of 3.76% in sales in 2015.

Primark is not a highly geared company, this show that the operation of the company is financed through equity. There is a slight decline on the dependence on outside sources of funding from 8.80% to 8%. This is good news for Primark. This indicates that for every £1 of capital employed 8% is debt and the rest of capital employed financed through equity.

The debt to equity ratio of Primark is very high debt-to-equity ratio. There is a slight reduction in the debt-to-equity ratio from 4.62:1 in 2014 to 3.83:1 in 2015. The debt-to-equity ratio indicates that the proportion of Primark’s assets financed by creditors are 4.62 and 3.83 times more in 2015 and 2014 respectively than the proportion of assets financed through Primark’s equity. The ratio also indicates that, for every £4.62 total liabilities in 2015 and every £3.83 of total liabilities in 2014, equity can pay £1 of it. The acceptable debt-to-equity ratio for most companies is 1.5 – 2. Primark’s high debt-to-equity ratio is as a result of purchasing most of its inventory on credit. The high debt-to-equity ratio does not necessarily mean Primark is risky for investors. Primark is able to generate enough cash because it sells for cash and has also got a favourable creditors collection period of 203 days.

Evaluation of Primark with Peers

Profitability

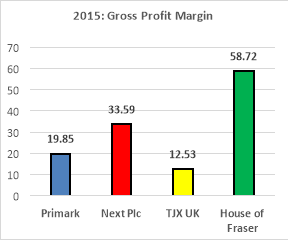

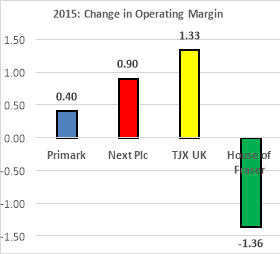

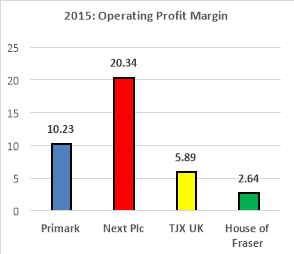

Primark and Next Plc managed less than 1% increase in gross margin for the year 2015. Next saw a little over one 1% increase in gross margin whilst House of Fraser recorded a decrease of 0.25% in gross margin for 2015. The gross margin of the four firms shows stability in gross margin. Operating margin saw an increase between 0.4% and 1.33% for Primark, Next Plc and TJX UK with only House of Fraser achieving -1.36% in operating margin. House of Fraser with its 58.72% gross margin could manage only 2.64% as operating margin. This is very bad. The picture shows House of Fraser is practising the premium pricing strategy where businesses set cost higher than their competitors as result records low sales. The operating profit margin of Next Plc is almost twice as much of Primark’s operating margin. Primark also recorded operating margin little below twice the operating margin of TJX UK whilst TJX UK recorded operating margin little over twice that of House of Fraser. Primark on profitability is doing well looking at the intense competition within the clothing retail industry.

Liquidity

Liquidity for Primark, Next Plc and TJX UK saw a slight increase in House of Fraser recording a decrease in current ratio. The slight increase in currency ratio means Primark earned 10p, Next Plc earned 6p, and TJX UK earned 28p more of current assets to pay short-term obligations. House of Fraser on the other hand lost 5p of current assets to pay short-term liabilities. The quick ratio is an indication that Primark, TJX UK and House of Fraser have inventory as the larger portion of current assets. Lenders and creditors are very much interested in this ratio as it helps them determine whether Primark, Next Plc, TJX UK and House of Fraser would be able to meet its future obligations. Primark has the least current and quick ratios of 0.37 and 0.05 respectively to £1 of current liabilities.

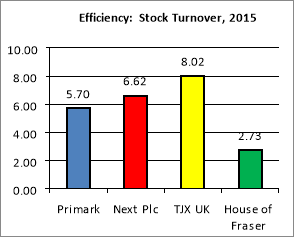

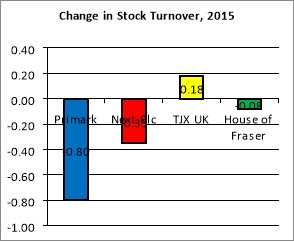

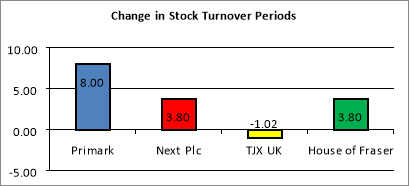

Efficiency

The efficiency with which Primark, Next Plc and House of Fraser use to turn its inventory into sale has reduced. Primark, Next Plc and House of Fraser all had a reduction in their stock turnover times for 2015 with only TJX UK having a slight increase in their stock turnover times which reduced their stock turnover periods by 1.02 days. The decrease in stock turnover for Primark, Next Plc and House of Fraser is insignificant at stock turnover ratio but that is not the same at the stock turnover periods level. The decrease in stock turnover led to an increase of 8 days in stock turnover periods for Primark and Next Plc with House of Fraser having 3.8 days increase in stock turnover periods. All other things being equal, a higher stock turnover and lower stock turnover periods are better.

The receivables turnover and receivables turnover periods indicates House of Fraser performed a little better than Primark, Next Plc and TJX UK. The ratios indicate Primark and Next Plc have relaxed credit policies for which debtor are taking advantage of it or they are having problems collecting from customers. All else equal, higher receivables turnover with lower receivables turnover period is better.

The 203 days accounts payable days of Primark shows Primark takes more than 6 months to pay creditors, House of Fraser takes more than 2 years to pay its creditors with its 733.67 accounts payable days. The account payable days of Primark and House of Fraser is an indication that they are paying creditors slowly which is good for Primark and House of Fraser on the other hand, it’s an indication of worsening financial conditions. Creditors would be comfortable with 28.97 days and 36.37 days account payable days of Next Plc and TJX UK respectively.

Analysis of the current business environment affecting UK clothing Retail Industry

The environments that affect the UK clothing industry can be categorised into Macro and microenvironment. The macro environments consist of factors that affect all organisations across industries. These factors would be analysed using the Porters Five Forces Analysis.

According to Grant 2005, the varying degrees of the factors within the business environment (industry) would determine the pressure, competition level and the profit it will make. The five sources analysed by Michael Porter are competition from new entrants, Competition from established rivals, competition from substitutes, bargaining power of buyers and bargaining power of suppliers.

Markets that are profitable keep on attracting new entrants and the clothing retail market is no exception. With a minimum capital requirement of the clothing retail market, it’s easy for new companies to enter and as a result of the eventual profits across the industry decrease. The only way that Primark and other big firms can secure their market is to take advantage of their economies of scale. Establish more outlets to enable them to sell at a cheaper price to induce sales. By this, new entrants would not be able to compete.

Customers have got over thousand and one substitutes to choose from within the clothing retail market. There are many well-established competitors and well-branded substitutes within the clothing retail market for customers to make a choice but the ultimate goal of the customer is to pay less for better quality. Primark should offer the best quality at an affordable price that customers would be able to pay.

The clothing industry is fragmented with the intense rivalry between retail companies. Next Plc, JTX UK and House of Fraser are all rivals to Primark but Primark has got some loyal customers who are satisfied with Primark’s brand. Primark should protect its brand as customers are interested in the brand they associated themselves with. Any negative reputation will affect Primark’s image which competitors would take advantage of.

The saturation of the clothing retail market has led to a highly competitive environment where customers have many brands to choose from. Buyers’ power is high as they have lots of alternatives to choose from. For Primark to defuse this power, it must offer lower prices, varieties of unique designs, high quality, quality customer service and solid brand image that customers would not be able to reject.

With the aim of attracting every potential buyer, suppliers of Primark would have lower supplier power the firm tries to satisfy the needs of its customers with variety. Primark source its products from cheap economies and suppliers have to supply based on agreed standards and designs.

SWOT Analysis of Primark

The SWOT Analysis provides strategic analysis of Primark’s business operations which would provide a competitive advantage over its competitors. This analysis shows the strength, weakness, opportunities and threats of Primark within the clothing retail market.

Strengths

- The business model of Primark is based on high sales volumes and lower retail margins with minimal advertising which enable it to offer low prices to customers.

- Primark takes advantage of bulk buying which help it to enjoy economies of scale to enables it to keep cost down.

- Primark has an extensive range of products including childrenswear, menswear, lingerie, accessories and footwear.

- Primark has got strong presence across UK and Europe with over 280 stores and also known in Ireland as Penneys.

- Primark employs about 50000 people around the world

Weakness

- Primark has outsourced its manufacturing line and this may lead to inconsistencies in quality.

- The slow economic growth of UK and EU has held the group profit back.

- The online retail channel is the faster’s retail market in the UK and Primark has no presence for the online market.

Opportunities

- Clothing is an essential product for everyone especially the youth population and that there is a constant demand for clothing.

- Primark should extend its presence to the USA, Africa, Middle East, China and India.

- One of the fastest growing segments of Primark is sportswear.

Threats

- Primark has got no presence in emerging markets like Africa and its sales are dependent on the health of the UK and EU economy so any shock to the economy would be a disaster.

- There is an intense competition between online retailers and physical retailers and Primark is no exception.

- Businesses like Primark with operations in Europe are griped with fear as the government approach to Brexit saga would affect their operations in EU market.

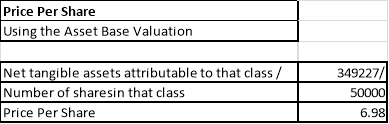

Share Valuation of Primark

Primark’s shares could be currently valued at £6.98 per share. Looking at the performance of Primark with its peers the stock price of Primark could be sold at a premium. I would recommend a £10 price per share for Primark’s stock in the IPO.

Conclusion

Primark rub shoulders with the big brands within the industry in terms of sales and have the potential for IPO. The corporate governance of Primark must be strengthening so that directors and officers would not take advantage of weak corporate government structure. With the worsening performance of the British pounds against the Euro and the US dollar, a critical assessment of the UK governments Brexit policies and the impact that Brexit would have on the UK economy and its relationship with the rest of Europe must be done. For now, I would recommend suspension of Primark’s IPO, to enable it to conduct a critical analysis of the Brexit Policies of the UK government and the impact it would have on businesses.

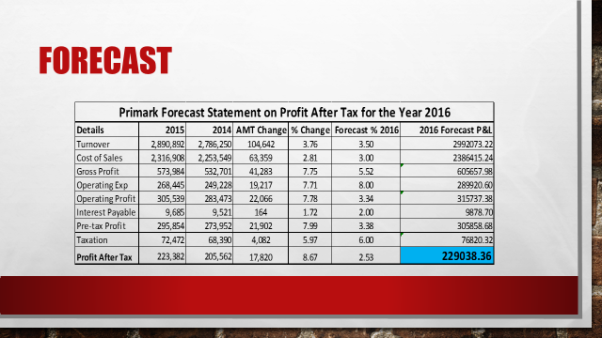

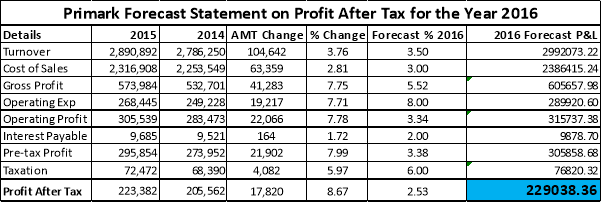

Forecast

With the financial year 2014 to 2015, Primark’s turnover increased by 3.76% we still presume that Primark would be able to achieve 3.5% increase in sales revenue. The weakening value of the British pounds as a result of Brexit will hit Primark because it sources its product in the US dollar. This would increase the cost of sales, operating cost and interest payable of Primark. The 3.5% expected increase in sales revenue and 3% increase in the cost of sale would result in an increase of 5.52% in gross profit. In all, it is estimated that Primark would be able to achieve about 2.53% increase in Profit after Tax for the year 2016.

Factors That May Impact Primark’s Share Valuation

Investors must carefully evaluate the information they obtain about an organisation to help develop current and future expectation value. The value of Primark would be determined by both internal factors, which are under the control of the management of Primark. Key factor that would influence the value of Primark are;

Profitability

The ability of Primark to generate a profit would attract investors to invest their resources into the company. Investors want to see appreciable returns on their investments and Primark has the prospect and ability to generate profit to multiply shareholders wealth.

Growth

For all other things being equal, companies with a strong demonstration of growth trends attracts potential investors and commands higher multiples. As Primark expand its presence in Europe, US, India and other emerging markets, it will create an opportunity for higher sales and profitability for which investors would be attracted to.

Risk

Investor wants to protect their investment by avoiding high-risk companies for less risk once. Investors would use any of the following to evaluate Primark as a high risk or less Risk Company.

Market analysis – the clothing retail market is open and there are no barriers to entry, Primark should put enough strategies in place so that the activities of new entrants would not affect it.

Management – Primark needs people with vast knowledge and experience on its management to implement its policies and strategies and set effective succession plan.

Internal control – investors would want to see the review and audit Primark’s financial statements.

Financial situation – investor would want to see Primark with the strong balance sheet to prove its financial position, capital structure this will help them determine if Primark would be able to meet its financial obligations.

Corporate Governance Recommendation

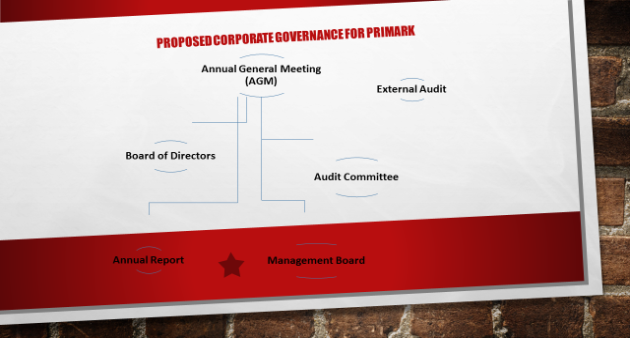

It’s a legal requirement of all companies seeking to get listed on the LSE to have a suitable corporate governance system impaled. Corporate governance is special machinery for regulating risk in organisations activities by preventing corporate disasters, scandals, and consequential losses and damages to investors, society and staff. To this end, Primark must have a suitable corporate governance policy in placed. We would recommend Primark to adopt the corporate governance structure below.

- Annual General Meeting – That is the highest decision-making body where directors would render accounts of their stewardship to shareholders and shareholders would have the opportunity to evaluate the report of directors to give them the opportunity to continue their stewardship or vote them out.

- Board of Directors – Primark should have a board where each member has the appropriate set of experience, independence, skills and knowledge to manage Primark.

- Audit Committee – there must be audit committee who will report to the board. Members of the audit committee should comprise of only members of Primark’s board whose responsibility would be to identify matters that needs action is taken or improvements and make recommendations with the processes to be taken. The audit committee has the duty to review internal controls, the integrity of financial statements and internal audit.

- Management Board – Primark should have a strong and well-experienced management board that would be responsible for the implementation of policy direction and strategies set by the board and the day-to-day running of the business.

- Internal Audit – there should be an internal audit unit that would provide an independent assurance that Primark’s risk management, internal control system and governance are operating effectively.

- External Auditor – as part of the requirements to list on the London stock Exchange, Primark needs to appoint an independent external auditor who will provide an independent opinion whether management has fairly presented the information provided in Primark’s financial statements.

- Annual Report – management of Primark should provide an annual report and get it approved by shareholders at the annual general meeting.

Benefits of Corporate Governance

Good corporate governance ensures corporate success and economic growth.

Strong corporate governance maintains investors’ confidence, as a result of which, company can raise capital efficiently and effectively.

It lowers the cost of capital.

There is a positive impact on the share price.

It provides proper inducement to the owners as well as managers to achive objectives that are in interests of the shareholders and the organisation.

Good corporate governance also minimises wasteges, corruption, risk and mismanagement.

It hepls in brand formation and development.

It ensures organisation is managed in a manner that fits the best interest of all.

Reference

Atrill, P., & McLaney, E. (2010a). Accounting and finance for non-specialists (7th ed.). Harlow, England: Financial Times/Prentice Hall.

Atrill, P., & McLaney, E. (2010b). Accounting and finance for non-specialists (7th ed.). Harlow, England: Financial Times/Prentice Hall.

Berk, J., DeMarzo, P., Harford, J., jo.., jarrad harford, & jarrad harford jonathan berk peter demarzo (2008). Fundamentals of corporate finance international financial reporting standards edition (Softcover Internatinal). Boston: Pearson Education (US).

Board, F. A. S., St, F. A., ., ards, & Financial Accounting Standards Board (FASB) (2004). Statements of financial accounting concepts: Accounting standards as of June 1, 2004. New York: Financial Accounting Standards Board.

Coltman, & Coltman, E. (2012). Refreshingly simple finance for small business: A straight-talking guide to finance and accounting. United Kingdom: Brightword Publishing.

Crowther, D., & Crowther, P. D. (2012). A social critique of corporate reporting: Semiotics and web-based integrated reporting (2nd ed.). Aldershot, England: Ashgate Publishing.

Emmanuel, C. R., Otley, D., & Merchant, K. (1995). Readings in accounting for management control (the Chapman & hall series in accounting and finance) (2nd ed.). London: International Thomson Business Press.

European edition. (2017, January 5). Retrieved January 6, 2017, from bloomberg.com, https://www.bloomberg.com/europe

Fund prices and data. (2016). Retrieved January 6, 2017, from Morningstar, http://www.morningstar.co.uk/uk/

Horner, D., & Gillespie, A. (2000a). Accounting and finance: An analytical and evaluative approach to business studies (A level B.. London: Hodder & Stoughton Educational.

Horner, D., & Gillespie, A. (2000b). Accounting and finance: An analytical and evaluative approach to business studies (A level B.. London: Hodder & Stoughton Educational.

Hrsg (2013a). Integrated reporting: Concepts and cases that redefine corporate accountability. Dordrecht: Springer International Publishing AG.

Hrsg (2013b). Integrated reporting: Concepts and cases that redefine corporate accountability. Dordrecht: Springer International Publishing AG.

Kim, S. H. (1998). Global corporate finance: Text and cases (4th ed.). Malden, MA: Blackwell Publishers.

Lee, T. A. (2006). Corporate governance and financial reporting. Chichester, United Kingdom: Wiley, John & Sons.

Limited, K. N. (2016, June 10). Primark stores limited. Retrieved January 6, 2017, from www.keynote.co.uk, https://www.keynote.co.uk/company-report/financials/profit-loss/00453448

(Limited, 2016)

Media, B. L. (2017). ACCA P2 corporate reporting (international & UK): Study text. United Kingdom: BPP Learning Media.

Appendixes

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal